SPECIAL: Join the Low Tax Business Setup Mini-Course for Just $147

Enroll NOW!Mini-Course for Location Independent Business Owners:

DISCOVER HOW TO SET UP YOUR BUSINESS IN A TAX-FRIENDLY COUNTRY WITHOUT

ACTUALLY MOVING THERE!

Proven Step-by-Step Video Course by former International Tax Lawyer Reveals How You Can Set Up Your Business In A Low-Tax Country and Start Saving Taxes TODAY… without Complicated Tax Codes, Expensive Lawyers, or Constant Worry about non-compliance.

You Don’t Need to be a ‘BIG tech company’ to have a Tax-Efficient Business Structure… You Just Need to Know which Countries are the Most Tax-Friendly for Your Business.

And what if I told you that you don’t need to be earning 7 figures to set up your business overseas?! Heck, there are some countries that charge less than $500 to get you set up.

Click the Button Below to get instant access to the Low Tax Business Setup Mini-Course for Just $297 $147!

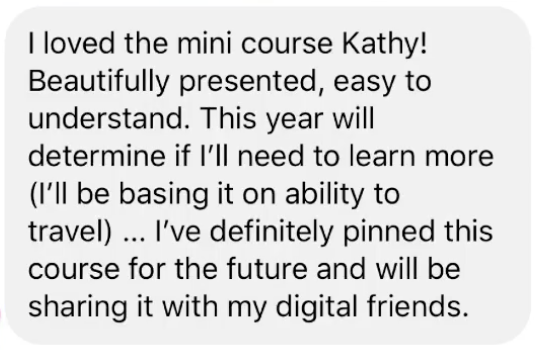

See Why Other Location Independent Business Owners are RAVING About This Training:

The REAL REASON You Don't Get To Keep Much of Your Business Income UNTIL Your Business is Set Up in a Low-Tax Country!

Chances are, you’re running a global online business and by that, I mean you can run your business from your laptop, anywhere in the world, and serve an international clientele.

BUT there’s something holding you back when it comes to taking your business to the next level because quite frankly you know that if you grow your business in your old home country it only equals a bigger tax bill and yet you’re wondering how other global entrepreneurs are able to set up their businesses in much friendlier tax countries and save a sh*t ton of money every year.

Inside of your head, it sounds a bit like this: ‘HELP?!’

- Where do I start learning about countries that are tax-friendly?

- Am I even allowed to set up my business in another country?

- Why is no one teaching these business fundamentals?

Look, I get it.

Google doesn’t seem to be of great help either... the only thing it does is spit out random names of countries you wouldn’t even know where to locate on a map such as Isle of Man, British Virgin Island, Cook Islands.

Well heck! Choosing the wrong country to set up your business only to later find out that these tax havens have an unreliable banking system and high auditing risk is NOT the solution you were looking for!

And that very thought keeps so many online entrepreneurs stuck.

The fear of wasting money to set up your business in the wrong country, choosing the wrong business structure, opening a bank account in a country with enormous banking fees… causes most online entrepreneurs to NEVER start at all.

And every single entrepreneur who gets stuck here – and stays stuck here – is making one of the BIGGEST mistakes that are guaranteed to keep them from raising their own salary when the majority of their business income still needs to go to the taxman.

And the worst part? They don’t even REALIZE they’re making a mistake that’s costing them thousands of dollars (and maybe you didn’t realize it either… until now).

This is a mistake I want to help you fix.

The Hard Truth is:

If you’re running a global business serving clients internationally, why would you confine the very foundation of your business structure to the borders of your old home country and not look into entrepreneurial-friendly countries that let you keep most of your well-deserved income?

So, let me help you.

Let me guide you through various different options where we’ve set up businesses for our clients which are viable options.

How would it feel if your business was set up in a country that is entrepreneurial-friendly, has low compliance obligations, low risk of being audited because they just make it so freaking easy for you to operate a business and are open to foreigners?

Yes, those countries do exist!

If you’ve ever wondered where other online entrepreneurs are setting up their businesses and how they decide where to incorporate, then that means you’re ready for this Mini-Course.

And just like I helped hundreds of students discover their country for a business setup, NOW I want to help you!

Why I'm Not Charging as Much as I Should for this Mini-Course:

Since starting my international tax consulting business, I’ve helped hundreds of online entrepreneurs with their business structures.

Having premium prices has allowed me to attract highly committed clients!

My VIP clients pay me $5,000+ for a Strategy Session and our prices are constantly increasing as we improve our offers.

So, in regards to this Mini-Course, I do not offer anything this inexpensive, and chances are never will again!

So, why now?

Over the past few years, I’ve seen so many GREAT entrepreneurs struggle with choosing a low tax friendly country. It stops them dead in their tracks. They stay stuck, and the easiest solution is to leave their business in the high-taxing country where they’re from and continuing to pay taxes in a country that they rarely spend any time in.

This means if you never get this figured out, your money continues to go to the tax man. instead of flowing towards the growth of your business.

So, it’s for that reason that I want to make sure I get this Mini-Course into as many hands as I possibly can so I can help you chose what country is the best to set up your business in.

Choosing a low tax country is ESSENTIAL. And when you finally do unlock your unique tax-friendly country, consider how many opportunities will immediately unlock for you and the future of your business.

If you would like my help and guidance in doing that, your investment price is just $147.

And by passing up this one-time offer, are you really saying that identifying real, viable low-tax country solutions is NOT worth $147 to you and that you would rather keep wasting your time on Google where all results are still written in a foreign tax language?

Let’s hope not!

So, if you are ready to finally lock in your tax-friendly country for your business set up so you can go on with growing your business, get registered by clicking the button below, and I’ll see ya soon!

Enroll in the Mini-Course NOW!BONUS E-BOOK:

Personal Tax Residency Fundamentals (value $97)

A 12-Page E-Book with an in-depth explanation of why your Personal Tax Residency is the foundation of your tax strategy. You will gain access to the tax glossary and step-by-step guidance on how to figure out your tax residency. This is normally a product reserved for my paying clients.

OMG YES! I WANT ACCESS!